Cerebras Systems closed a massive $1.1 billion Series G funding round in September 2025, pushing its valuation to $8.1 billion.

The oversubscribed round was co-led by Fidelity Management & Research Company and Atreides Management, with participation from Tiger Global, Valor Equity Partners, 1789 Capital, and existing backers Altimeter, Alpha Wave Global, and Benchmark.

This marks one of the largest private AI infrastructure funding rounds of 2025, positioning Cerebras as a serious contender against Nvidia's GPU dominance.

What Makes Cerebras Different?

Founded in 2015 by Andrew Feldman, Gary Lauterbach, Michael James, Sean Lie, and Jean-Philippe Fricker, Cerebras pioneered wafer-scale computing for AI workloads. The five co-founders previously worked together at SeaMicro, which AMD acquired for $334 million in 2012.

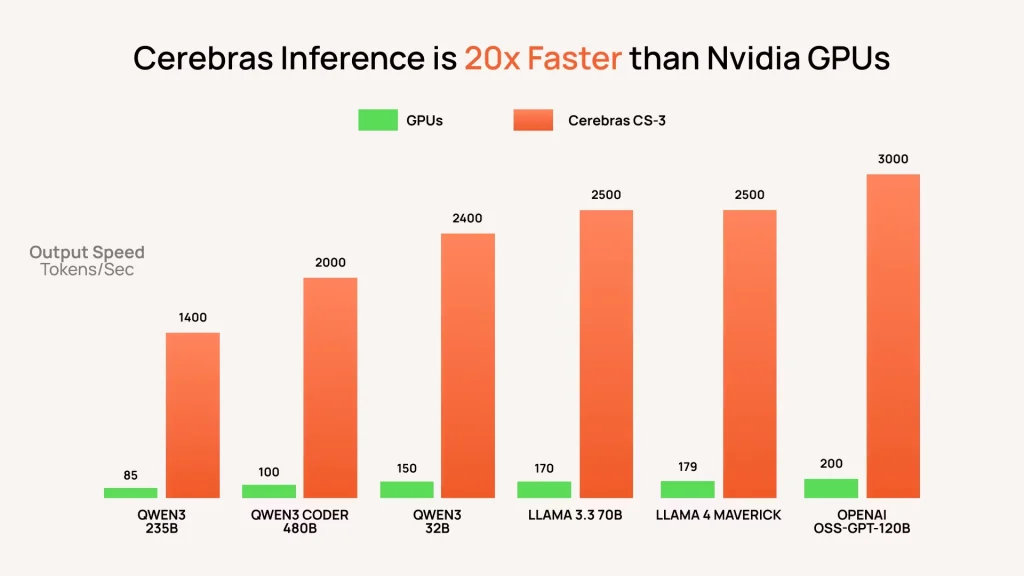

Cerebras builds the Wafer Scale Engine (WSE), the world's largest semiconductor chip with nearly a million AI-optimized cores integrated across an entire wafer.

This design eliminates the communication bottlenecks that plague multi-GPU clusters, delivering speeds over 20 times faster than Nvidia GPUs for inference tasks.

Why This Investment Matters Now?

The AI industry is shifting from training models to deploying them at scale. Inference computing has become the critical bottleneck for enterprises running real-time AI applications.

Cerebras will use the fresh capital to expand U.S. manufacturing capacity, build more data centers, and accelerate development of its wafer-scale processors. The company already serves major clients including AWS, Meta, IBM, Mistral, and the U.S. Department of Defense.

CEO Andrew Feldman stated the company plans to double its U.S. manufacturing footprint and extend data center capacity to meet explosive demand for Cerebras products.

Key Funding Facts

Who led the Series G investment?

Fidelity Management & Research Company and Atreides Management co-led the round, with significant participation from Tiger Global, Valor Equity Partners, and 1789 Capital.

What will the capital be used for?

Expanding U.S. manufacturing capacity, building new data centers across North America and Europe, and advancing wafer-scale chip technology.

How much has Cerebras raised total?

Approximately $1.87 billion across seven funding rounds from 2016 to 2025.

What's Next for Cerebras?

Cerebras postponed its planned 2024 IPO amid regulatory scrutiny over foreign partnerships. The Series G raise buys time to diversify its customer base and prove sustainable revenue growth before hitting public markets, likely in 2026.

The company must also scale wafer-scale manufacturing, which faces yield and cooling challenges compared to modular GPU clusters. Competition is intensifying as Nvidia releases Blackwell GPUs and cloud giants build custom silicon.

Cerebras Funding History

| Round | Amount | Date | Valuation | Lead Investors |

|---|---|---|---|---|

| Series A | $27M | May 2016 | Undisclosed | Eclipse Ventures, Foundation Capital |

| Series B | $25M | Dec 2016 | Undisclosed | Benchmark |

| Series C | $60M | Jan 2017 | Undisclosed | Sequoia, Scale-Up |

| Series D | $81M | Nov 2018 | $1B+ | Coatue, VY Capital |

| Series E | $272M | Nov 2019 | $2.4B | Undisclosed |

| Series F | $250M | Nov 2021 | $4B | Alpha Wave Ventures |

| Series G | $1.1B | Sep 2025 | $8.1B | Fidelity, Atreides Management |

Cerebras Social Media

| Platform | Link |

|---|---|

| Website | cerebras.aicerebras |

| linkedin.com/company/cerebras-systems | |

| X (Twitter) | @CerebrasSystems |

| YouTube | youtube.com/CerebrasSystems |