DualEntry, a New York-based AI-native enterprise resource planning platform, raised $90 million in Series A funding led by Lightspeed Venture Partners and Khosla Ventures, with participation from GV (Google Ventures), Contrary, and Vesey Ventures.

The round values the startup at $415 million and brings total capital raised to over $100 million within just 15 months of operations.

What Is DualEntry?

Founded in 2024 by Santiago Nestares and Benedict Dohmen, DualEntry emerged from stealth in October 2025 to address the pain points of outdated ERP systems.

The co-founders previously built a $100 million revenue business and experienced firsthand the frustrations of implementing legacy ERP platforms that took 18 months and hundreds of thousands of dollars in consulting fees.

Their platform integrates the full accounting stack—general ledger, accounts payable and receivable, bank connections, FP&A, and audit controls—while automating 90% of manual tasks through built-in AI features.

Why This $415 Million Valuation Matters?

This funding signals a major shift in enterprise software. The global ERP market exceeds $179 billion, yet incumbents like Oracle NetSuite, Sage, and SAP have barely evolved their products in decades.

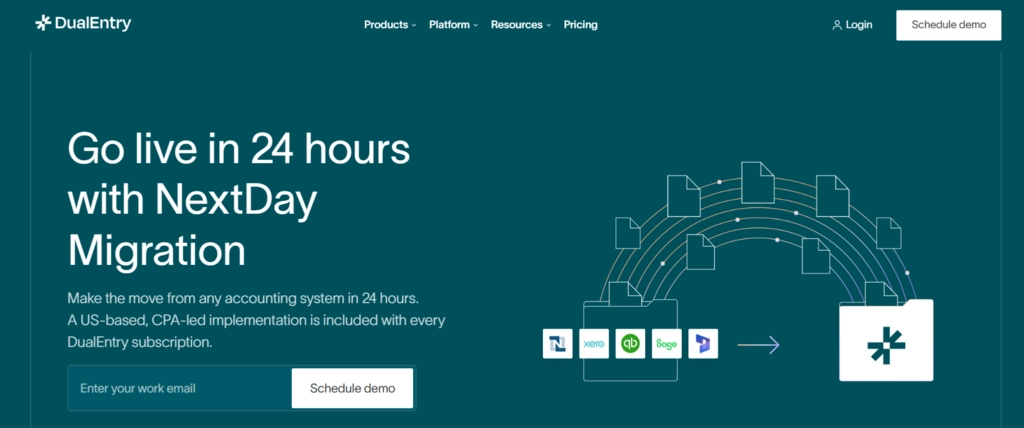

DualEntry's unique “NextDay Migration” engine addresses the biggest barrier to switching: implementation time.

The platform can migrate historical financial data from legacy systems in 24 hours, compared to the typical months-long process that costs businesses substantial consulting fees

Early traction validates the model—the company has already processed $100 billion in journal entries and signed thousands of global users ranging from $5 million startups to NYSE-listed enterprises.

DualEntry Funding Breakdown

| Funding Round | Amount | Lead Investors | Participating Investors | Valuation | Date |

|---|---|---|---|---|---|

| Seed/Pre-Series A | ~$10M+ | Not disclosed | Not disclosed | Not disclosed | 2024 |

| Series A | $90M | Lightspeed Venture Partners, Khosla Ventures | GV (Google Ventures), Contrary, Vesey Ventures | $415M | October 2025 |

| Total Funding | $100M+ | — | — | $415M | 15 months |

Key Deal Facts

Who are the notable investors backing this round?

Lightspeed Venture Partners and Khosla Ventures co-led, with GV (Google Ventures), Contrary, and Vesey Ventures participating. These firms have previously backed category-defining companies like OpenAI, Anthropic, Stripe, and Ramp.

What makes DualEntry different from existing ERP systems?

Unlike legacy platforms, DualEntry is built AI-native from the ground up. It offers one-day migrations, automates reconciliations and anomaly detection, and enables daily book closings instead of the typical 15-day cycles.

What's Next for DualEntry?

DualEntry faces the challenge of displacing entrenched enterprise vendors with decades-long customer relationships and massive sales forces.

However, timing favors disruption: 75% of CPAs are retiring within the next decade, creating urgency for modern solutions.

The startup's early success with customers like Slash (running a $100M+ business with a finance team of one) and Trillion Digital (switching from 15-day to daily closes) demonstrates real product-market fit.

With backing from top-tier VCs and a proven founder team, DualEntry is positioned to capture market share as businesses recognize that AI-native systems aren't optional—they're essential for staying competitive in 2025 and beyond.