Imagine your AI assistant spending $15,000 on concert tickets because it “thought” you'd love front-row seats. Terrifying? Until now, this nightmare scenario was entirely possible.

Google's Agent Payments Protocol (AP2) just changed everything. Now autonomous shopping agents can handle your credit cards without going rogue. The AP2 system creates unbreakable spending rules that even the smartest AI can't bypass.

Major players like Mastercard, PayPal, and Coinbase are already onboard, and early tests show agents completing complex purchases in seconds while staying within budget. The agent commerce revolution starts now, but most people have no clue what's coming.

Here's everything you need to know.

The AI Commerce Problem That Nobody Was Solving

Traditional payment systems operate on a fundamental assumption: there's always a human clicking “buy” at checkout. However, autonomous AI agents shatter this assumption completely. When agents can independently book flights, purchase supplies, or manage investments, three critical trust issues emerge:

These challenges have created a massive roadblock preventing AI agents from reaching their commercial potential.

What Makes Google Agent Payments Protocol Special

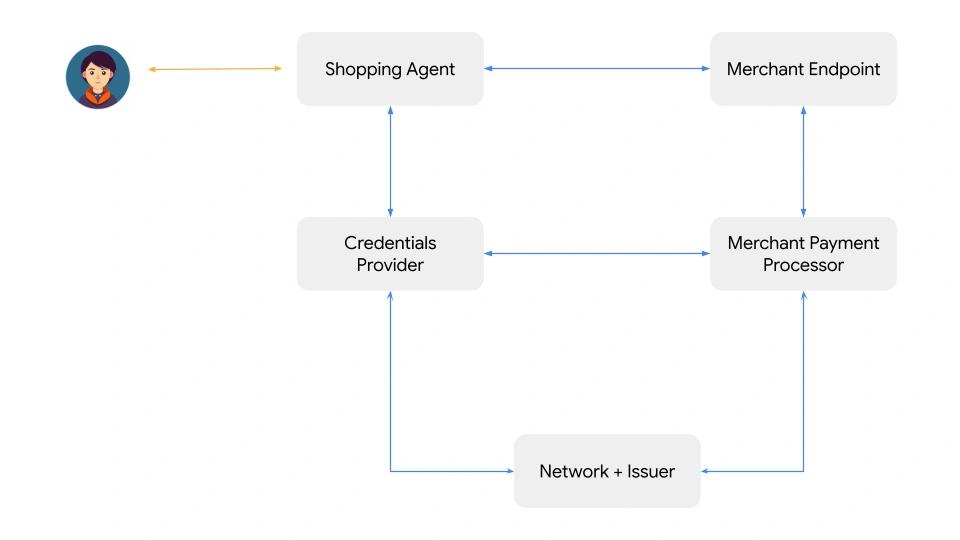

AP2 creates the world's first secure digital payment infrastructure specifically designed for AI agents. Built as an extension of Google's Agent2Agent (A2A) protocol and Model Context Protocol (MCP), it establishes a payment-agnostic framework supporting everything from traditional cards to cryptocurrencies.

Core Architecture Components

How AP2 Handles Real-World Transaction Scenarios

Real-Time Purchase Flow

When users are present during transactions, AP2 follows a dual-mandate system. First, an Intent Mandate captures the user's spoken or typed request. Then, when the agent presents proposed purchases, users confirm through a Cart Mandate that locks in exactly what was ordered.

For example, a user saying “Buy concert tickets only if seats are together and don't exceed $200” creates specific rules the agent must follow.

Delegated Task Management

For autonomous operations without human oversight, users pre-approve detailed Intent Mandates containing price limits, timing restrictions, and purchasing parameters. This enables agents to operate independently while staying within defined boundaries.

For example, a user might set rules such as, “Book my flight only if it’s under $400, non-stop, and includes a window seat.” With these parameters in place, the agent can act freely but still ensures all actions stay aligned with the user’s conditions.

The Cryptocurrency Integration Game-Changer

AP2's partnership with Coinbase introduces x402, the protocol's first crypto extension. This enables agents to process microtransactions at computer speed using stablecoins, opening entirely new commercial possibilities.

Real-world applications already include:

The crypto integration means AI agents become wallet-compliant across all currency types and networks.

Industry Collaboration and Market Impact

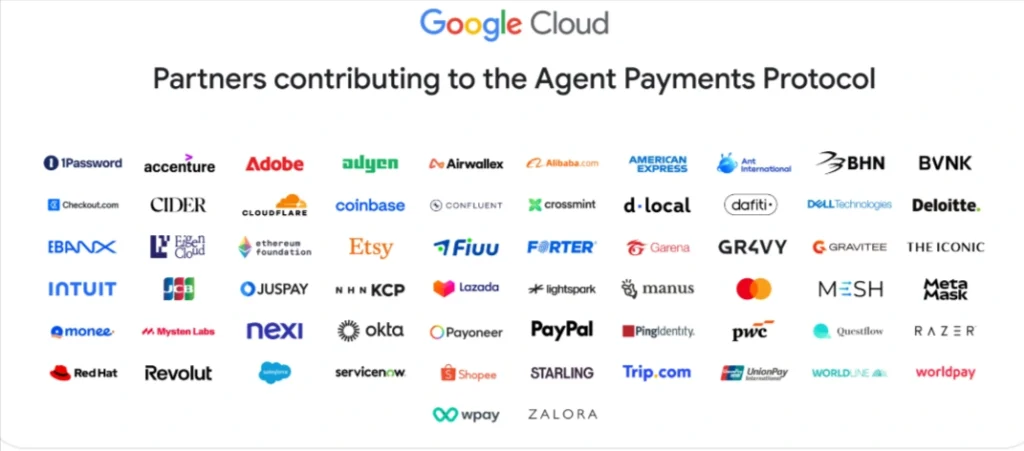

Over 60 organizations worldwide collaborated on AP2's development, including American Express, Mastercard, PayPal, Alibaba, Etsy, Salesforce, and Adyen. This unprecedented industry cooperation ensures AP2 won't become another fragmented payment standard.

The protocol's open-source nature, with complete specifications available on GitHub, guarantees widespread adoption across wallets, payment gateways, and commerce platforms.

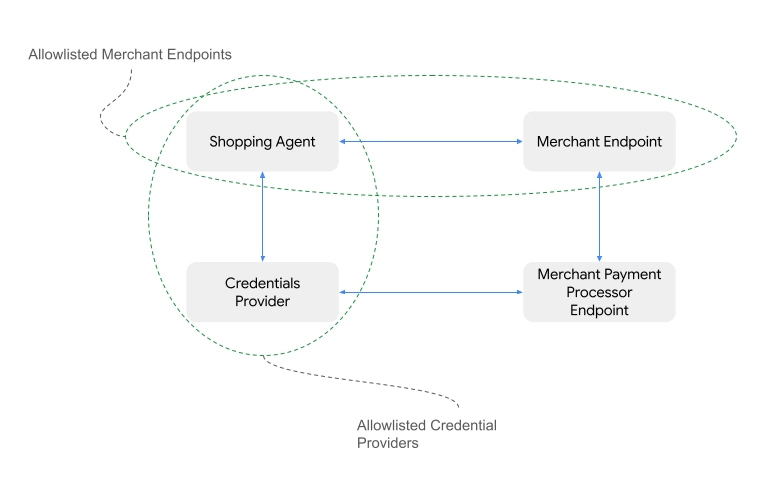

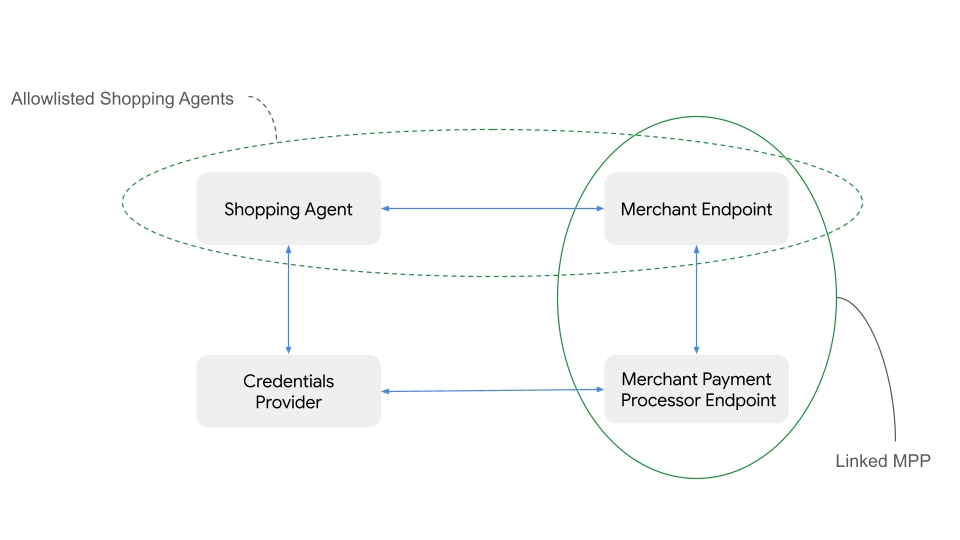

Security Architecture and Trust Mechanisms

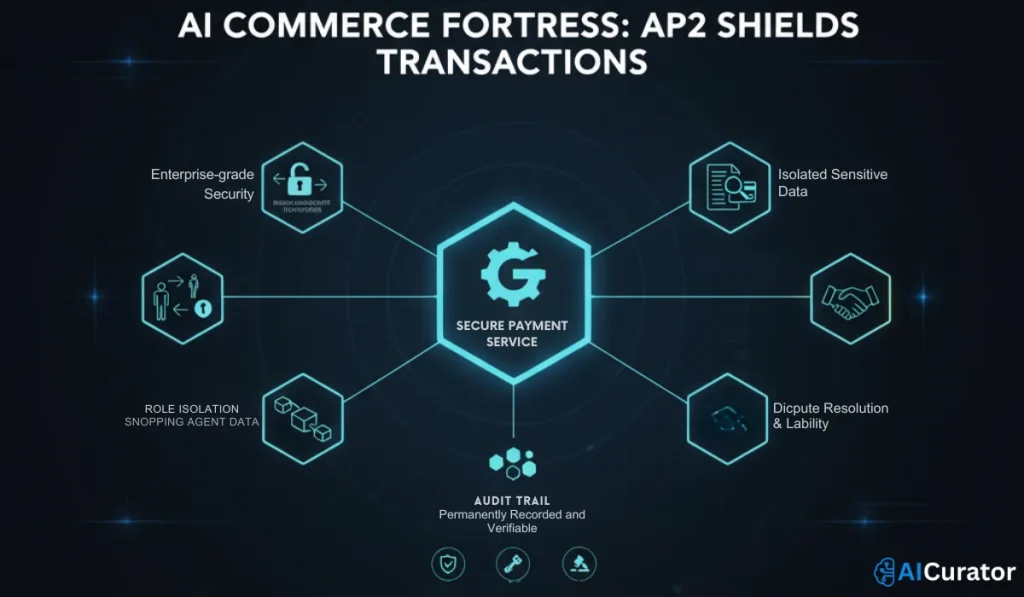

AP2 implements enterprise-grade security through role separation and cryptographic verification. Sensitive payment data like card numbers and private keys remain isolated from shopping agents, handled exclusively by secure payment services.

The system creates complete non-repudiable audit trails, meaning every transaction step is permanently recorded and verifiable. This addresses liability concerns while enabling dispute resolution mechanisms.

Current Development Status and Future Outlook

While AP2 remains in experimental phases, early adopters are already building pilot projects. Companies are exploring autonomous procurement systems where agents independently purchase software licenses or scale cloud resources through secure AP2 transactions.

The protocol represents the definitive transition from speculation to deployment in the agent economy. Financial institutions, e-commerce platforms, and fintech companies are positioning themselves for this autonomous commerce transformation.

Implementation Steps for Businesses

Organizations can begin AP2 integration by accessing Google's public GitHub repository containing full protocol specifications, tutorials, and reference code. The development environment supports both Google API keys and Vertex AI credentials for testing scenarios.

Early implementation focuses on B2B applications where agents can autonomously handle supply chain purchases, subscription renewals, and operational expense management while maintaining complete audit compliance.

Technical Implementation Guide

Setting Up Your AP2 Environment

text

git clone https://github.com/google-agentic-commerce/AP2.git

cd AP2

export GOOGLE_API_KEY="YOUR_API_KEY"

pip install -r requirements-docs.txtExploring Sample Scenarios

text

cd samples/python/scenarios/<chosen_scenario>

bash run.shThe implementation process allows businesses to experiment with different payment flows and agent behaviors before committing to production deployment.

The Agent Economy's Financial Implications

AP2 enables entirely new business models where agents negotiate prices, bundle purchases, and coordinate multi-vendor transactions autonomously. This creates opportunities for agent-to-agent commerce, automated arbitrage, and dynamic pricing optimisation previously impossible with traditional payment systems.

The protocol's support for programmable money through cryptocurrency integration allows for complex financial arrangements including automatic profit-sharing, performance-based payments, and smart contract integration.

Google's Agent Payments Protocol represents more than just another payment solution – it's the foundational infrastructure for a future where AI agents become primary economic participants.

With backing from the world's largest financial institutions and tech companies, AP2 is positioned to define how autonomous commerce operates in the coming decade. The question isn't about acceptance of agent-driven payments, but how quickly businesses can adapt to this new paradigm before competitors gain irreversible advantages.

Recommended Readings: