EvenUp has closed a $150 million Series E funding round led by Bessemer Venture Partners, pushing its valuation past $2 billion—more than doubling in under a year.

The round drew participation from REV, B Capital, SignalFire, Adams Street, Premji Invest, Bain Capital, HarbourVest, Lightspeed, and Broadlight Capital, bringing total funding to $385 million.

What Problem Does EvenUp Solve?

Founded in 2019 by Rami Karabibar, Saam Mashhad, and Raymond Mieszaniec, EvenUp tackles a fundamental challenge in personal injury law: the justice gap.

Millions of injury victims face a legal system where cases drag on for years, settlements fall short, and smaller law firms lack resources to compete.

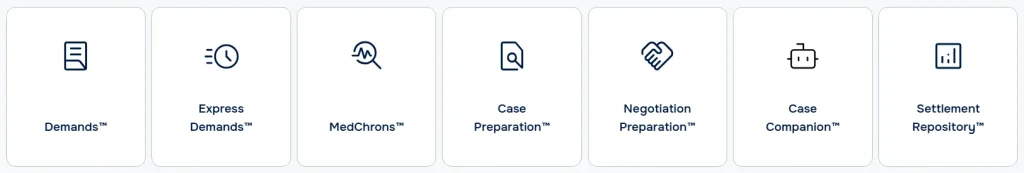

EvenUp's Claims Intelligence Platform, powered by its proprietary Piai™ model trained on hundreds of thousands of cases and millions of medical records, automates document generation, case strategy, and legal workflows.

The platform doesn't just assist lawyers—it drafts demand letters, reviews medical chronologies, and prepares negotiations at scale.

Why This Deal Signals Major Market Shifts?

This funding round represents one of the largest in legal AI history and arrives at a pivotal moment. Legal tech funding hit a record $2.5 billion in 2025, driven by AI's proven ability to automate complex legal work.

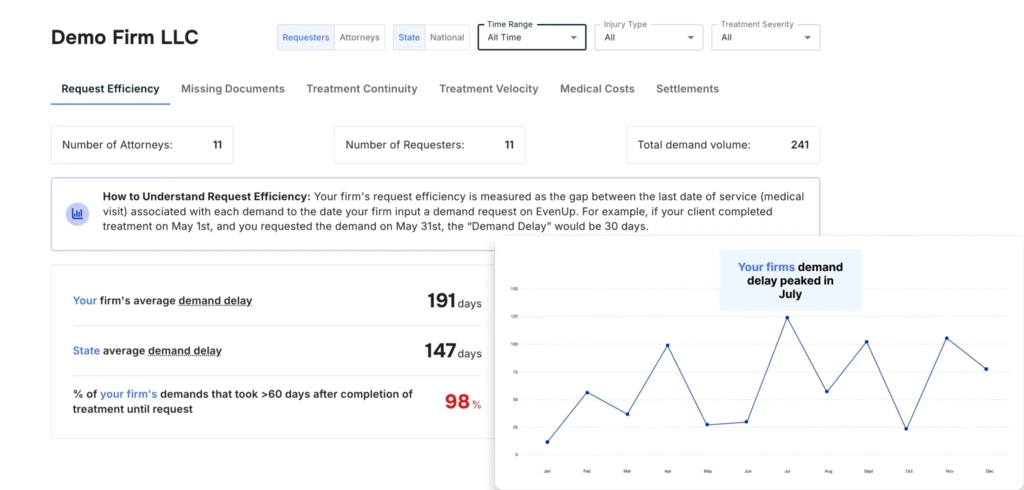

EvenUp's numbers validate investor confidence: the platform now processes 10,000 cases weekly—nearly double the volume from six months ago—and has helped resolve over 200,000 cases representing $10 billion in settlements.

More than 2,000 law firms, including 20% of the top 100 U.S. personal injury practices, now rely on EvenUp. Annual recurring revenue has doubled year-over-year, with 90% of new sales coming from products launched this year alone.

The company plans to use the capital to advance its AI models, accelerate product development, and expand operations across North America. Notably, this marks EvenUp's fourth funding round in just 24 months, each preempted by investors—a rare signal of market conviction.

Investment Landscape Analysis

EvenUp's valuation jump from $1 billion to over $2 billion in less than 12 months reflects broader investor appetite for vertical AI solutions that demonstrate measurable ROI.

Unlike general-purpose AI tools, EvenUp's domain-specific approach—trained exclusively on personal injury case data—delivers immediate value: firms report revenue growth exceeding 70% without adding headcount.

One Ohio firm increased a settlement offer from $50,000 to $1.75 million using EvenUp's real-time case analysis tools.

The backing from REV, the venture arm of RELX (LexisNexis's parent), signals that legacy legal information providers recognize AI platforms as essential infrastructure rather than competitive threats.

What's Next for EvenUp?

EvenUp faces the challenge of maintaining its product velocity while scaling to meet surging demand. The company recently launched Mirror Mode, which generates custom legal documents that match a firm's writing style and winning templates.

As more firms adopt AI-powered workflows, EvenUp's competitive advantage lies in its proprietary dataset and first-mover position in personal injury AI.

The real test will be expanding beyond document automation into predictive analytics and settlement optimization—areas where AI could fundamentally reshape how cases are valued and resolved.