What if your next stock pick came from crunching billions of data points in seconds, spotting hidden patterns humans miss?

Stock Analysis with Deepseek delivers exactly that—fusing technical charts, fundamental metrics, and real-time sentiment scans into actionable trades. Forget outdated screeners; this platform turns casual queries into backtested strategies, linking straight to your broker for instant execution.

With open-source efficiency slashing costs, retail investors now access pro-level quantitative tools for smarter, faster decisions across volatile markets. Ready to test it on your watchlist?

Key Takeaways

What Makes DeepSeek Different for Market Analysis?

Unified Data Integration

Traditional market analysis is often siloed—technical, fundamental, and sentiment data rarely sync. DeepSeek changes this by analyzing them together. For instance, it can merge ITC’s price trends with sentiment from earnings calls and budget news for sharper insights.

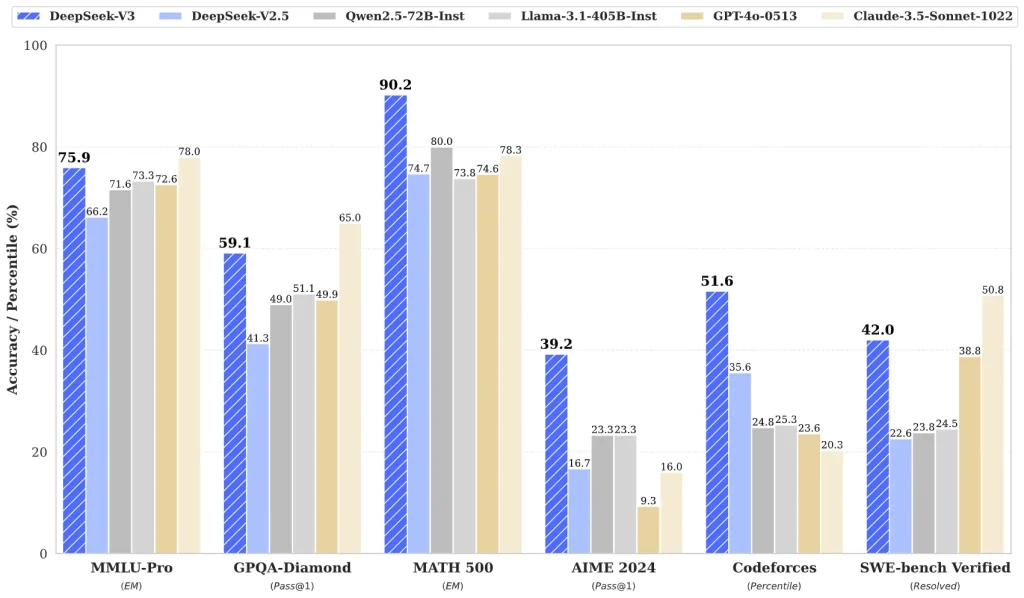

Cost-Efficient AI Infrastructure

DeepSeek achieved remarkable efficiency by using approximately 2,000 H800 GPUs for training, compared to 16,000 GPUs typically required by competitors. This resource optimisation translates to lower operational costs and more accessible pricing for end users.

The platform employs Mixture of Experts (MoE) architecture and multi-head latent attention, significantly reducing inference costs whilst maintaining high-quality analysis capabilities.

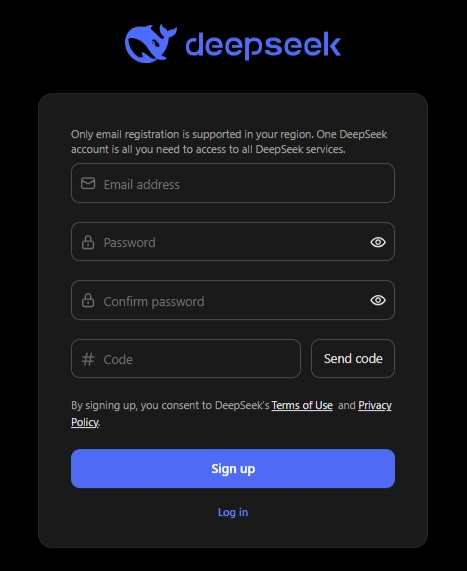

Setting up DeepSeek

- Create an account on deepseek.com or install the mobile app.

- Select a model:

- DeepSeek-Chat (general research)

- DeepSeek-Reasoner (long chain-of-thought, 64k context)

- Plug in data sources via the “Finance” add-on or your brokerage API.

- Set risk profile (conservative, balanced, aggressive) so prompts align with your strategy.

Step-by-Step Guide: Stock Analysis with DeepSeek

1. Frame the prompt

Example:

text

Compare Apple (AAPL) and Microsoft (MSFT) on Q2 2025 free cash flow,

gross margin trend, and CEO tone in earnings calls. Spot technical breakouts

using 50- and 200-day EMAs. Summarise in a table.This single prompt fuses fundamentals, sentiment and chart signals.

2. Review the output

DeepSeek returns:

3. Validate numbers

Cross-check key figures against SEC filings or your data terminal to avoid hallucinations.

4. Drill down with follow-ups

Ask:

text

Back-test a long-only strategy: buy when sentiment >0.3 and 50-day

EMA crosses above 200-day, hold 30 days. Period 2019-2024.DeepSeek generates CAGR, max drawdown and Sharpe ratio.

5. Export or execute

Advanced Features for Professional Analysis

Quant Strategy Builder

With tools like Go-Stock, users can turn plain-English trading ideas into executable algorithms—complete with backtesting and simulated orders.

Asset Correlation Insights

DeepSeek maps links between assets, sectors, and macro trends to uncover diversification gaps and systemic risks.

Real-Time News Alerts

The AI monitors news, earnings, and regulations 24/7—flagging high-impact events and scoring sentiment for smarter, faster decisions.

Common Challenges and How to Handle Them

DeepSeek may hallucinate on lesser-known stocks, as flagged in 2025 research. To counter this, cross-check with official data and limit to well-covered markets. Geographic bias from its Chinese training data can skew Indian sentiment scores, so verify with local sources.

Transparency issues arise since reasoning isn't always clear, per Wikipedia notes. Use audit trails where possible and combine with human oversight. Regulatory gaps, like SEBI's lack of LLM rules in 2025, mean users must exercise caution.

Tips for Better Results with DeepSeek

DeepSeek AI offers a solid path to efficient stock market analysis, backed by 2024-2025 advancements. With its low-cost models and broad capabilities, it supports informed trading decisions. Always pair it with personal research for the best outcomes.

Recommended Readings:

What It All Means

DeepSeek presents a new frontier in financial analysis, but it is not a substitute for sound human judgment. The best results come from blending its immense data processing capacity with personal market knowledge and solid risk management. Leveraging its strengths while maintaining control over final decisions ensures a balanced approach.

This harmony between AI precision and human insight can lead to more confident and informed trading choices.

Understanding its capabilities, alongside its limitations, is crucial for making it a valuable component of your investment strategy. Consider exploring its features to see how it can help sharpen your own approach to the markets.